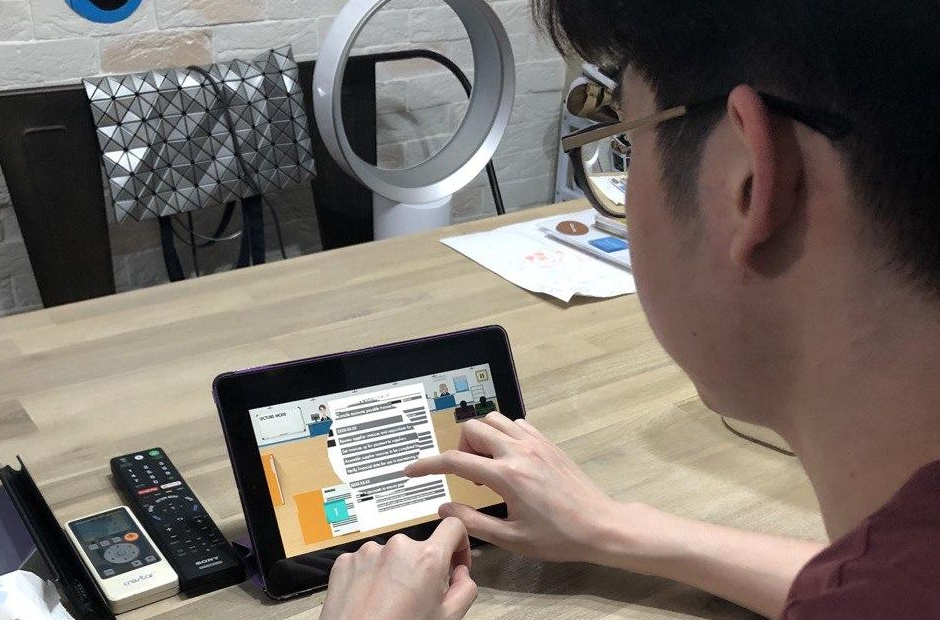

You would not usually associate the study of accounting with mobile games. But Dr Seow Poh Sun’s game “Red Flags – Accounting Fraud” brought the two together to spice up the study of a subject that students sometimes view as dry.

The Associate Professor of Accounting at Singapore Management University’s School of Accountancy, says, “The game is a fun way to help students learn how to identify accounting fraud. It helps sharpen their eye at sifting out deceptive accounting tricks.”

By offering simple gamification features such as a scoring system, as well as colourful graphics, the students are motivated to pick up accounting insights even during their downtime between classes. Along the way they learn concepts like the role of internal controls in accounting systems and the evaluation of impact on internal controls, a process of checks and balances in a company’s procedures to ensure they comply with the law.

.jpg)

Associate Professor of Accounting at SMU Dr Seow Poh Sun

The game was developed by Dr Seow and his colleague Professor Gary Pan with support from the Teaching Pedagogy Grant from SMU’s Centre for Teaching Excellence, which helps faculty members design advanced teaching methods.

Learning anywhere, everywhere

Red Flags puts students in the shoes of an auditor, whose role is to spot and highlight errors and irregularities in company documents. A “sticky note” is shown at the start of each task, to remind the students of the learning objective of the task. It also provides explanations and examples on how to vet a document.

Once the students have checked through the documents, they can decide to approve them (if there are no errors) or reject them (if red flags are spotted). They then submit these documents to the game’s “boss”.

The students earn points by submitting as many correct documents as possible within a given time. The “boss” sends outs a note identifying the errors if an incorrect document is submitted. The tasks get more difficult as the game progresses, allowing students to challenge themselves with different levels of auditing exercises. The game provides immediate feedback to the players so they can learn from their mistakes quickly.

Appealing to digital natives

Dr Seow is a big believer in using technology to enhance teaching. The students of today, he says, enter university as digital natives, always carrying tablets and smartphones. By tapping into this interest and capability, educators can encourage students to brush up on their learning outside the classroom in a fun way.

“They have fun and build up accounting knowledge on the go,” says Dr Seow.

“The students are encouraged to download and play the game but it is not a compulsory or graded activity. I did not want students to feel pressured to play the game. However, during the class, I link the concepts that I taught to the tasks within the game,” he adds.

The tangible impact

Melvin Teh Wey Ho, a 3rd year SMU student majoring in Accountancy and Finance, says that the game has helped to reinforce his understanding of the concepts taught in class.

“One of my lectures covered the segregation of duties for an employee managing both account payable and cash disbursement master data. I was able to run through 16 instances of such scenarios within the game. This is useful because I now know how to apply the principles in my exams,” says Melvin.

He also relishes the challenges in the game as it presents real issues in the Audit industry, allowing him to be better prepared when he enters the workforce.

A screenshot from the Red Flags: Accounting Fraud game

“By running through realistic industry scenarios, I gain valuable insights into the different parts of the company business cycles, such as the importance of checking for segregation of duties between the approval of cash receipts and bank approval (a process to manage and account for transactions),” says Melvin.

To date, Red Flags has logged nearly 1,000 downloads, and students have reacted positively to the game. According to Dr Seow, 20 students surveyed last year said “that their knowledge of accounting fraud and internal controls has been enhanced after playing the game”.

A handy tool

While mobile educational games have to be fun to play if they are to be effective, “the test is to see if there are tangible improvements in students’ understanding of the subject and coursework”, says Dr Seow.

However, Dr Seow points out that at the end of the day, this is a tool to supplement learning.

“E-learning is not perfect. While I believe in using technology to support it, it cannot replace the human instructor.”